ExxonMobil worked with a company connected to a senior Conservative party figure to transfer an oil asset in Liberia despite “concern over issues regarding US anti-corruption laws”, the Guardian can reveal.

Documents seen by the Guardian show that ExxonMobil proposed a complex financial arrangement to move the rights to a Liberian oil block through two financial transactions on the same day, after concerns were raised about the original allocation of the rights.

Under the arrangement, a company called Peppercoast sold rights in a west African oil block to a company called Canadian Overseas Petroleum Limited (COPL). Viscount Astor, the father-in-law of David Cameron, the former prime minister, is a director of COPL, which is registered in Bermuda.

COPL then immediately sold the majority of the asset to ExxonMobil.

The Liberian rights had originally been assigned to a company called Broadway Consolidated before transferring to Peppercoast in 2010. According to documents seen by the Guardian, Broadway Consolidated’s shareholders included a lawyer linked to a senior Liberian official who was involved in allocating the asset.

A report, by Liberia’s auditor general, said the original process of handing the assets to Broadway was “compromised by bribery and influence peddling”.

A spokesman for COPL said the company had fully investigated the findings in the auditor general’s report, and found there were no irregularities. It said it had insisted on a fully transparent process for the deal, which required approval by a vote of both the Liberian congress and senate, as well as the approval of multiple Liberian ministries.

The Guardian has seen a document that states that “due to ExxonMobil concern”, two contracts were to be created and the asset moved from Peppercoast to COPL and on to the US oil company within less than 24 hours in April 2013. Global Witness is publishing a report on the deal on Thursday.

Jonathan Gant, senior campaigner at Global Witness, said: “Exxon and COPL structured a complex deal to buy their oil licence, although as our report published today shows, the block they bought had questionable origins.”

ExxonMobil paid about $120m (£85m) for the asset, Block 13. COPL retained about 17% of the asset as a result of the deal.

As part of the deal, which was signed off in London, Peppercoast agreed to “undertake action to limit payment to certain shareholders to cash”.

ExxonMobil and COPL also requested that Liberia agree that “past irregularities will not affect [the contract] or its new owners”.

A spokesman for COPL said: “[COPL] and Exxon Mobil carried out their own due diligence exercise and found no evidence to support the allegations and found credible evidence that the allegations of impropriety were entirely false.”

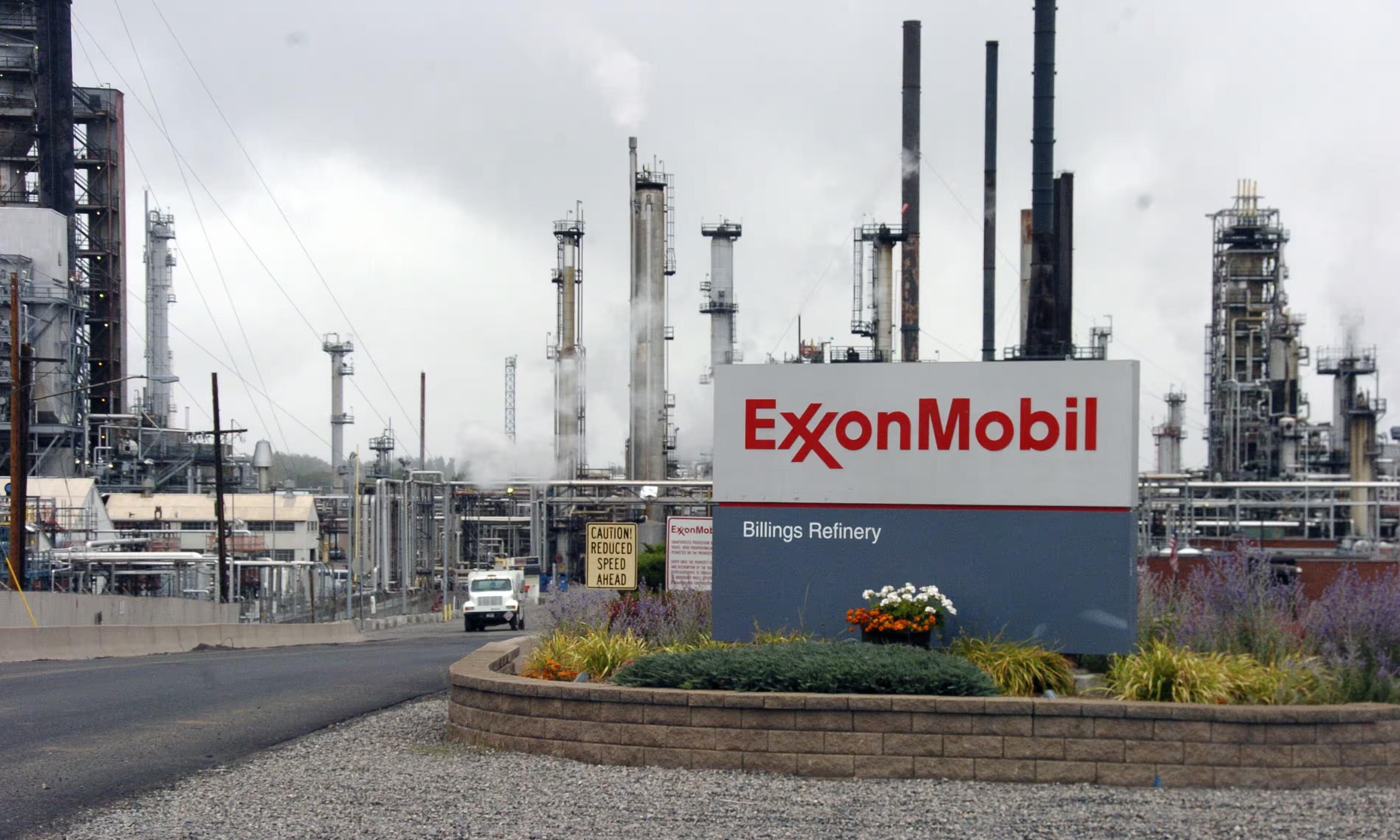

An Exxon spokesperson said: “ExxonMobil has an unwavering commitment to honest and ethical behaviour wherever we do business. We have a long-standing commitment to compliance with the US Foreign Corrupt Practices Act and the anti-bribery laws of the countries and territories in which we do business.

“ExxonMobil complies with all applicable laws and regulations. The process of this transaction was transparent, and the terms of the production sharing contract are publicly available.”

ExxonMobil is based in Texas and has revenues of more than $200bn a year. Rex Tillerson, the former chief executive of Exxon, was fired from his role as US secretary of state by Donald Trump earlier in March.

Concerns were raised over the ExxonMobil deal by campaigners in Liberia in the run-up to 2013, because Block 13 was believed to be one of the country’s most valuable natural assets and the original allocation had been controversial.

Before the deal went through, Lord Flight, a Conservative peer and a shareholder in Peppercoast, wrote to Henry Bellingham, who was then a Foreign Office minister.

Bellingham and Flight were both Conservative MPs together for several years.

In May 2011, Flight wrote to Bellingham asking him to monitor attempts by Liberians to block the sale of the asset, saying that he was “a modest shareholder in the company along with other British shareholders”.

“Peppercoast is not seeking any specific help [but] wishes to advise NOCAL [the National Oil Company of Liberia] that the FCO [Foreign Office] is aware of Peppercoast Petroleum’s situation.”

Liberia has received billions of dollars in aid from the international community, including the UK since the civil war that ended in 2003.

The friendly email concludes: “As you will assume, there is substantially more material on this matter which I have emailed to you separately.”

The Foreign Office has refused to publish this information.

A month after Flight’s email, in the grand surroundings of London’s Draper’s Hall, Bellingham introduced Ellen Johnson Sirleaf, then the Liberian president, to Peppercoast representatives.

Bellingham said: “I do indeed recall attending the UK/Liberia Investment Forum at Drapers’ Hall in my capacity as the minister for Africa. The idea behind this Investment Forum was to boost UK/Liberia trade, and I attended the event along with a number of Foreign Office officials and members of UKTI.”

Flight said: “I was aware, as a modest shareholder in the company, that Peppercoast Petroleum was experiencing problems with the National Oil Company of Liberia and my email to Henry Bellingham duly advised him that I was a modest shareholder in Peppercoast, along with other British shareholders.

“My email to Henry Bellingham specifically did not request any assistance from the FCO but made it clear that it was to advise the FCO of Peppercoast’s situation.”

David Cameron travelled to Liberia in February 2013, meeting both the then president and Robert Sirleaf, her son , who was then the chairman of NOCAL, which oversaw the transfer of the asset to Exxon.

A major interest in Peppercoast was held by RAB Capital, a London-based hedge fund. RAB Capital is a major Conservative donor, as are both founders, Michael Alen-Buckley and Philip Richards. They were both members of the Leader’s Group, which requires a minimum donation of £50,000 a year to the party.

Viscount Astor, who is married to Samantha Cameron’s mother, became a consultant for COPL, and then a director. Several Conservative donors had shares in Peppercoast.